Who Is Kevin Warsh, and Is He Good for Gold? Kevin Warsh’s Fed nomination points to reform and discipline – not upheaval. Markets reacted with cautious relief, even as gold suffered a sharp one-day sell-off. Here’s why that move says more about leverage clearing than about gold’s long-term role…

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

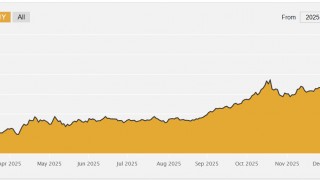

Gold Clears $5,000 as Economic Stress Builds

Gold rocketed past $5,000, silver just crossed $100 and the headlines are grasping for explanations – from tariffs to politics. When the narratives stop making sense, it’s usually a sign of something deeper. This week, let’s look at the signals…

Full Article →The Retirement Math Americans Get Wrong

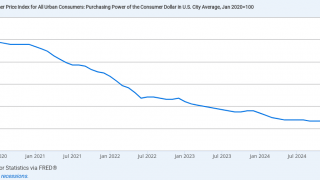

You can do everything right – save diligently, plan ahead, follow the rules – and still come up short in retirement. The problem isn’t effort. It’s assumptions: Inflation, healthcare, and living costs don’t behave the way we expect. So what can we do?

Full Article →How Currency Stress Is Pushing Gold & Silver to New Highs

As Bloomberg reported, the most recent reports are having trouble keeping up with gold’s gains. The article is written by an analyst from Singapore, whose timezone is 13 hours ahead of Eastern Time. For them, the market is open almost a full day ahead of the New York spot maket on Sunday, and they’ve been watching gold soar.

Full Article →Former Treasury Secretary Sounds Alarm on Debt

When a Treasury Secretary Sounds the Alarm, We Should Pay Attention. Former Treasury Secretary Robert Rubin says today’s debt trajectory echoes past periods of financial strain. Treasury data backs him up. Here’s why rising interest costs and structural deficits matter more than any headline…

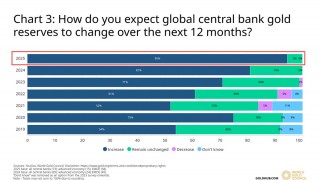

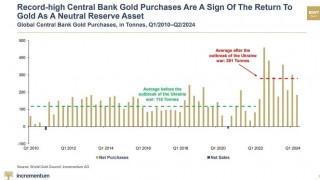

Full Article →Why Are Central Banks Escalating Gold Buying?

Gold is creeping higher with almost no fanfare, silver is surging to fresh records, and even Russia is warning that G7 nations may seize foreign reserves. Beneath the headlines is a simple reality: trust in global finance is eroding, and physical precious metals are quietly becoming the preferred safe harbor…

Full Article →Gold: Under-Owned, Under-Supplied and Overdue

Gold is still just 2% of global assets, even as physical supply runs a 1,000-ton deficit and new demand surges from central banks and a surprising new source. UBS sees silver outperforming gold in the short-term for similar reasons. Here’s what you need to know…

Full Article →Two Investing Titans Issue the Same Warning

Two very different billionaires, one warning: When Ray Dalio and Jeff Gundlach – two legendary investors with wildly different worldviews – start warning about the same thing, it’s worth paying attention. Both say today’s economy is distorted, and warn that “illusory wealth” may vanish when reality hits…

Full Article →Silver Just Gained a Historic Advantage

As gold rebounds past $4,000, the lone bearish forecast quickly collapses under its own logic. Meanwhile, silver gains new strategic importance on Washington’s “critical minerals” list. Here’s why gold and silver are poised to shine even brighter. Rounding up the most important stories about precious metals

Full Article →Who Will Survive This “K-Shaped Economy”?

Economies usually go just one way – but now we’re going in two directions. While the wealthy ride up on rising asset prices, millions of working Americans are moving down. Here’s how the “K-shaped” economy took hold – and what it means for your financial future…

Full Article →AI Bubble? Gold Savers Will Win the Long Game

Gold’s brief slide below $4,000 has pundits cheering – but traders, not fundamentals, drove the move. Silver’s scarcity tells a different story, and Bank of America now recommends gold as the smart hedge against the frenzied AI boom… Your News to Know rounds up the most important stories about precious metals.

Full Article →New Trend: Family Arguments Over Inflation

As rising costs squeeze younger generations, a disturbing trend is spreading: “inheritance impatience.” Adult children are pressuring parents (and grandparents) for early access to their estates – draining retirements before they begin… Let me start with a question you’ve probably never asked yourself

Full Article →Welcome to Staglflation 2.0

CEO confidence has slipped below the danger line, signaling what many already feel: Higher prices, slower growth, and fading optimism. With inflation rising and growth stalling, even corporate America sees the specter of 1970s-style stagflation returning… And concerned Americans are doing the same things that many CEOs are planning for right now.

Full Article →Forget the “Great Wealth Transfer”… This Is Far Worse

When governments run out of money, they don’t tighten belts – they borrow and print. That’s called “debasement,” and it quietly drains value from every dollar we earn and save. Here’s how the “debasement trade” is changing the investing landscape… And how are central banks being used to do it

Full Article →Why Economic Growth Is Losing Its Meaning

Growing up, illusions were a wonderful thing. Watching David Copperfield fool the audience on television was amazing, even magical.As you get older, though, you realize that there are really two different types of illusions, one magical and wonderful. The other, a sort of con game to distract us from paying attention to what really matters.

Full Article →Why This Gold Surge Is Different (It’s a Revolt!)

Gold has doubled since 2023 and forecasts call for much higher. But this isn’t just another rally. While the Fed cuts rates and analysts warn of the global currency crisis, gold’s record run looks more like a rebellion against unbacked currency itself. Your News to Know rounds up the most important stories about precious metals…

Full Article →China Challenges Dollar Dominance Like Never Before

You’re probably already aware that the U.S. dollar has had its worst start to a year since 1973. That made headlines worldwide. Now, the U.S. has been the world’s reserve currency for decades meaning that the dollar has been, essentially, the yardstick by which other currencies are measured. A decline in the dollar’s value is bad news.

Full Article →The Real Reason Gold Is Surging

(They Don’t Want You to Know This) Gold has surged to $3,600, yet mainstream media still struggles to explain why. The truth is simple: Currencies are weakening worldwide. No wonder central bank gold buying is surging, and silver is stepping into the spotlight. Here’s what happens next…

Full Article →2 Reasons Gold Is Smashing Records AGAIN

Gold just surged past $3,500 as mounting debt and looming Fed rate cuts shake confidence in the dollar. Silver is quietly outperforming, while turmoil in West Africa adds fuel to supply concerns. Here’s what’s next for gold and silver prices…

Full Article →Fed Feuds Make Headlines – Debt Makes the Rules

Trump vs. the Fed makes for great theater. But while the media fixates on name-calling and accusations, the real story is fiscal dominance. We live in an age of distractability. Every second that you’re awake of every day of the week, we are surrounded by, submerged in a constant never-ending barrage of information, marketing, and viewpoints…

Full Article →First came Goldman Sachs, then Morgan Stanley – and now analysts at Swiss megabank UBS have recommended that investors buy gold as a hedge against economic turbulence. Those same analysts have adjusted their gold price forecasts modestly: $3,600 by Q1 of next year; $3,700 by Q2.

Full Article →Trump saves global gold market – can he do the same with the U.S. dollar? Of course President Trump said no gold bullion will be subjected to tariffs. Consistent with the original Liberation Day tariff announcement. The Customs & Border Patrol opinion on Swiss gold bars was just a mistake. Story’s over, nothing to see here, move along. So let’s zoom out…

Full Article →It never ceases to fascinate me how people have a tendency to only remember the things that they actually want to hear… It’s like those car dealerships that promise, “Just $199 down and $199 per month and you can drive away in a brand new car today!” The ad isn’t lying – not exactly. It’s just that the offer might only allow…

Full Article →Gold is holding steady – for now, but not for long. With the Fed cornered and global demand rising, $4,000 gold might be right around the corner. And if today’s bull market is like the 1980s run, how much higher will gold go? Your News to Know rounds up the most important stories about precious metals and the overall economy.

Full Article →From Bolivia to Tanzania, central banks are buying up locally mined gold – paying in local currencies, too, rather than dollars. With gold supply tighter than ever and silver poised for a breakout, here’s what the smart money is doing right now… Your News to Know rounds up the most important stories about precious metals and the overall economy.

Full Article →A leading research firm says gold could climb to $5,500 by 2030 – and that’s their conservative estimate. We break down the global money supply explosion, strange Swiss gold moves and hints Russia plans to target silver price in a quiet war on the West…

Full Article →Central banks are buying gold like never before. Russia just nationalized a major gold miner, Tether launched a “digital gold” token while billionaires are doubling down on bullion. The message is clear: Owning gold is no longer optional… Your News to Know rounds up the most important stories about precious metals and the overall economy.

Full Article →We’re Your Ringside Seat for the Rio Reset – For the first time ever, Birch Gold is putting boots on the ground. Phillip Patrick and Peter Reagan are heading to Brazil to cover the Rio Reset live, as it happens. Here’s why this is a turning point in the war on the dollar’s dominance – and American prosperity…

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.