The intraday reversal in silver just below my $120 target (at $117.75) might have marked the final top for the time being, or we might see another attempt that takes silver to $120 or even a bit above it before a bigger decline (that is then followed by an even more epic silver rally)

Full Article →Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

Will the Greenland Threat Push Silver to $120?

A Greenland deal could actually happen. Silver could temporarily rally based on all this. The Greenland saga continues, and it also continues to be remarkably similar to what happened last year regarding the tariff war with China. This title (from Yahoo Finance) pretty much sums it up…

Full Article →The USD Index’s Rally Is Quiet – For Now…

Silver futures are flat while gold futures and mining stocks are down – that’s yet another small confirmation of the disconnect between the silver market and the rest of the precious metals sector. They will all react to some factors, but silver has many more reasons to rally in the medium term.

Full Article →Gold Price Forecast for November 2025

This time, the gold price forecast is not as much about predicting gold prices, as it is about realizing what’s going on in the USD Index. The Fed cut rates. Again. The USD Index rallied. Also, again. The Fed’s decision to cut rates again was widely expected, so it was “in the price” for some time now but…

Full Article →Gold Stocks Refuse to Rally with Gold

The GDXJ ETF, proxy for junior and mid-tier gold/silver miners looks like it’s done rallying, and its move above $100 will be invalidated shortly. No wonder. We saw a daily reversal, which happened on big volume, and it all took place at the vertex of the lines creating the previous rising wedge formation, which itself broke to the downside.

Full Article →U.S. Government Shuts Down… For A Short While

It turns out I was wrong regarding the government shutdown when we look at it at first sight, but I don’t think I’ll be proven wrong on this in the practical sense of what I wrote. The fact that we did see the government shutdown doesn’t change that much. What matters is how long it will remain shut down.

Full Article →How Far Is Too Far for Gold Stocks?

My recent gold price forecast for August 2025 included a detailed analysis of the current analogy between now and the 2011 top, and this link remains up-to-date, especially with regard to mining stocks’ strength. Consequently, in today’s analysis, I’d like to focus on the two key things…

Full Article →Gold Price Forecast for July 2025

Let me tell you a story. You already saw it, but this time, it’s presented so clearly that it would be a shame not to cover it. It’s a story about the precious metals market, and it comes in six chapters. And it is this story that will serve as the short-term basis for the gold price forecast for July 2025…

Full Article →Ceasefire or Not – Gold Is Still Declining

Yesterday I wrote that the Peak Chaos was likely reached and now the markets are likely to react to even moderate levels of chaos as if the latter was gone, or low. On top of that, it seems that Trump’s previous plan to create uncertainty giving him leverage in negotiations is now turning into the stage where some results would be necessary.

Full Article →The Market Situation Really is Crazy These Days

The situation in the Middle East has just worsened, and gold is doing nothing. The situation is escalating daily – this is the perfect scenario in which gold – the king safe-haven asset – should rally. Not only is this NOT happening, but gold is actually down ($14) in today’s pre-market trading. What gives?

Full Article →Platinum’s Strength – Finer Points

Platinum is still in the spotlight, and the analogies just keep coming. In yesterday’s analysis, I focused on the surprising (to many) implications of platinum’s outperformance, and today, I’d like to provide you with an update. Let’s start with a quote from yesterday’s analysis…

Full Article →“Buy America”, Keep Gold as Insurance, and…

The “sell America” trade is getting a lot of attention these days, but it seems that enough is enough. The about-to-be-hiked tariffs for the EU were delayed by a month (precisely: to at least July 9), and it looks like we’re getting the same kind of story as we’ve seen recently. First, threat, then, escalation, followed by delay, putting pressure on the other side.

Full Article →OOF What a Slide in Gold!

And Oooh What a Jump in the USDX! Both are completely unsurprising, as the technical analysis (and common sense) provided insights beforehand. Yes, the U.S. – China dramatic tariff decrease announcement was the direct trigger – the technical writing was on the wall for a long time. This goes in particular for the situation in the USD Index…

Full Article →Lessons for Gold Investors from USDX, Bitcoin and Gold Stocks

The markets are relatively calm today, but don’t let that fool you. They are about to MOVE. There are multiple clues as for the way in which the markets are likely to move next, and I’m going to discuss three of them in today’s free analysis. One of them is about the USD Index, the other is about bitcoin, and…

Full Article →Gold, Silver, USDX: The Key April Analogies and Key Factors

“Nearly half of the fund managers surveyed (49%) see long gold, or bets that gold prices will rise, as the most crowded trade in the market right now. This marks the first time in two years that fund managers did not see the Magnificent Seven as Wall Street’s most crowded trade, according to the survey.”

Full Article →Gold Topped – But Did Silver?

Given today’s decline in gold, it appears that we took profits pretty much right at the top on Friday – at least in the case of gold – but… Was that the final short-term top? To clarify, we had gone long on Jan. 2, and I then moved the profit-take level for gold higher – to $2,733 on Jan. 3.

Full Article →What a Week in Gold! Wait, It’s Just Tuesday…

Gold plunged by almost $80 yesterday… And it doesn’t look like the decline is going to end (!) anytime soon. Sure, there will be corrections, but the bearish train appears to have finally left the station, as I’ve been expecting it too previously. Gold broke below its rising support line, which is a strong sign that the trend has changed.

Full Article →Gold Price Forecast for October 2024

Gold price likely reached its upside target, and the top is in. Yes, you read that right. And yes – this creates a bearish forecast of gold prices for October 2024. On a short-term basis, gold invalidated the move above its rising support/resistance line, which serves as a bearish confirmation.

Full Article →Tech Stocks, Return to “Normalcy” and Gold Stocks

The precious metals market moved slightly higher yesterday. But the move up was too small to change anything, especially in the case of the GDXJ and FCX. The moves higher have indeed been tiny in those two – they were barely noticeable.

Full Article →Gold’s Quick Reversal and Copper’s Major Indications

Copper is definitely the most important industrial metal out there. In the entire commodity sector, only crude oil is more widely used. This doesn’t mean that the only way in which its price can move is up (far from it), but it does indicate that this market is likely linked to multiple other markets – also to gold price.

Full Article →Perfect Combination for Dollar, Perfect Signal for Gold

It’s rare when a target is reached so perfectly as it’s the case in the USDX right now. In yesterday’s analysis, I provided a lot of contexts for the current prices moves. Today, I’ll focus on the short-term price moves and I’ll start with the market where we saw the clearest, immediate-term indication: the USD Index

Full Article →Gold Tops and Silver is… Being Silver

The USD/YEN breakout is a fact and one that’s being confirmed. Gold now forms lower intraday highs. What’s next? No surprise here – gold, silver, and miners appear to have topped, so the next move is likely to be to the downside, just as I explained it in my previous analyses.

Full Article →Gold Forecast: Surfing Extreme Sentiment Waves in Gold

Gold is rallying regardless of what’s happening in other markets. And while there are signs of a top, gold appears to simply not care about them at the moment. In particular, the gold price keeps on forming daily reversal candlesticks, which “should” be tops, but they likely aren’t.

Full Article →Gold AND USD Both Break Higher – What Gives?

Gold’s moving higher and… the USD Index is moving higher as well, which one is faking it? In the recent past I commented on gold’s performance as being similar to what we saw in 2011. Today’s move higher makes the similarity less clear, but still intact.

Full Article →Bitcoin Invalidated Its Breakout – Is Gold Next?

Gold price held up well yesterday. But will it be able to handle the USD Index’s breakout? The yellow metal moved back to the Dec. 2023 high and bounced from it, and today, it just did the same thing. Yesterday’s price action looked quite promising, as the verification of the breakout would indeed be a bullish thing.

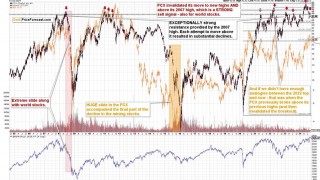

Full Article →Quarter Later: History Rhymes for Gold Stocks

Gold and gold miners moved higher yesterday, turned a few heads, and now they’re back down. What’s next? Yesterday might have seemed like a big deal, but… If you read my weekend Alert, you knew that seeing a double-top here was one of the possibilities that would NOT change the outlook. After all that’s how gold topped in 2011.

Full Article →Gold Price Forecast for March 2024

Forecasting gold prices is not easy, but right now it seems that we have quite many factors aligned. The market buys on rumors and sells on facts – even if they are positive. But if the facts are negative… Then the market sells substantially, and the price declines significantly. For now, the market continues to exaggerate its reaction…

Full Article →Gold & Stocks Might Be Doing Something Critical Here

Miners declined as expected, but today’s action is so far in gold and stocks. Both will impact miners. Let’s start with gold. From the daily point of view, we just saw another move toward the 61.8% Fibonacci retracement based on the recent decline. This level was not touched, let alone broken. Today’s intraday high wasn’t above the Friday’s intraday high.

Full Article →Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.