Investors have to manage their emotions and deal with surprises in order to succeed. This is particularly true for bullion investors, who can expect more than their share of volatility and unexpected price action. Gold and silver are not favored assets, unlike real estate, Treasuries, or U.S. equities…

Full Article →Clint Siegner

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group, and winner of Bullion Dealer of the Year’s E-commerce category.

A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.

Government Shutdown Theatre Fuels More Gold Gains

Rumors of a federal government shutdown are once again swirling. Absent a deal, non-essential agencies will have to suspend operations until legislators put together a spending deal. Americans have another front row seat to the public relations battle between Republicans and Democrats to see which party is most to blame for the impasse.

Full Article →Cost of Living Is Falling Fast… Relative to Gold

Rising prices are a political football with politicians on both sides of the aisle eager to pin blame on the other party. Both sides are correct. Politicians, along with the central bank they created and continue to endorse, are fully responsible for the affordability crisis and the fading American dream.

Full Article →The Best Way to Buy Silver Right Now?

Bid and ask premiums for 90% silver U.S. coins are perhaps the most volatile of any among retail bullion products. At the recent peak of retail buying demand in 2023, ask premiums for these older, circulated dimes, quarters, and half dollars went north of $15/oz over spot. Today, ask premiums are south of $1/oz.

Full Article →Gold Revaluation, Bitcoin Reserve, and Other Shell Games

Rumors of gold revaluation have been in the news lately. One thing is clear. Politicians have no interest in using the nation’s gold reserves for anything like the original purpose. Americans get smoke and mirrors instead. Officials may like to point to the large reserves and talk about the confidence all that gold inspires.

Full Article →Price discovery for precious metals is complicated. There are several different markets for gold and silver. These markets include the retail bullion market, the London spot market, and the COMEX futures market. Another market is called Exchange of Futures for Physical (EFP). The EFP process was developed as a means for institutional investors…

Full Article →Americans are accustomed to assets being priced in terms of Federal Reserve note dollars. It makes sense, of course. The dollar is the currency of the realm. There is, however, a real problem with using it as a benchmark. It’s an eye-opener to measure how key assets have performed with gold, rather than the dollar, as the benchmark.

Full Article →Gold has outperformed most asset classes for the last 25 years. If you think about it, that is a pretty remarkable run. Economic conditions varied widely, but gold held up better in tough times as well as during periods of growth. In all likelihood, no one who held gold through the past couple of decades regrets it. Why has gold done so well?

Full Article →Silver prices dropped 12% in the final two trading days of last week. Gold lost 2.6%. While gold has held up relatively well, silver fell in tandem with the general stock market after President Trump announced reciprocal tariffs against nations that impose a levy on goods from the U.S. – Bullion was exempted – coins, rounds, and bars will not be subject to the tariff.

Full Article →Washington D.C. is still a prime breeding ground for bad ideas. One of the dumbest, and more dangerous, is the idea of swapping U.S. gold reserves for Bitcoin. Bitcoin and gold may share some of the honest money fanbase, but that is about as far as any similarities go. One is tangible and time tested. The other…

Full Article →It would be great if major institutions were trustworthy, competent, and efficiently run. But fixing these institutions first requires recognition of the problems. The people who spent all of their time marginalizing gold bugs as nutjobs and conspiracy theorists are starting to find themselves out on the fringe.

Full Article →Is the Shortage of Large Bars Temporary?

Traders with an obligation to deliver physical bars in the U.S. have found the available inventory is in short supply. They have been rushing to import supplies from London and/or paying hefty premiums to secure the bars they need. Others have been capitalizing on arbitrage opportunities.

Full Article →Will Fed Waste & Abuse Finally Get Attention Too?

Americans got an eyeful of the waste and fraud which has been rampant in federal spending last week. A barrage of announcements by the Trump administration included putting the brakes on a $50 million program to buy and supply condoms to people in Gaza.

Full Article →These 3 Catalysts Could Fuel Precious Metals Markets

Longtime bullion investors have been evaluating whether to buy, sell, or hold in recent months. The change in leadership in Washington DC has prompted some searching as to the direction of the markets. Demand for precious metals tends to come in three broad categories: inflation hedging, safe-haven buying, and speculation.

Full Article →Sound Money Would Check Government More Than DOGE Can

Many Americans are rooting for Donald Trump and his appointees to succeed in their herculean task of slowing or reversing government growth. There is much discussion about how runaway big government might be stopped. But there hasn’t yet been talk about how to keep it that way.

Full Article →Elon Musk Targets the Fed

Elon Musk offered to include Ron Paul in the Department of Government Efficiency (DOGE) – a presidential advisory commission headed by Musk and Vivek Ramaswamy. DOGE is tasked with finding waste, fraud, and abuse in the federal government and making recommendations for how to eliminate it.

Full Article →Inflation Not Likely to Go Away

Gold and silver futures speculators began selling contracts in anticipation of a Trump victory. Thus far, the selling continues after his win. The markets may have simply been overbought after big moves higher in October. However, the impact of the election cannot be discounted.

Full Article →How the Election Could Impact Precious Metals

Donald Trump is picking up steam in recent polling. Bullion investors are tuned into presidential politics, this year perhaps more than ever. They wonder what the November election might mean for markets. Absent some radical development, either Trump or Harris will be president come January. And Gold investors better be ready!

Full Article →Scammers Using Gold to Fleece Americans for Everything

One of the primary reasons that investors turn to physical gold and silver is to eliminate counterparty risk. Bullion.Directory precious metals analysis 30 September, 2024 By Clint Siegner Director of […]

Full Article →Will Electric Vehicles Be the Killer App for Silver?

Industrial demand for silver has been surging in recent years. Solar panel manufacturers were largely behind the 11% jump in demand for 2023 versus the prior year. Forecasters predict another 9% jump this year. For silver investors, however, the future of demand from manufacturers may be even brighter than the recent past.

Full Article →Americans are questioning all sorts of government functions these days. For example, the majority of people, according to polls, have doubts as to whether U.S. elections are free and fair. Some believe the federal justice system has been weaponized and used against those in political opposition.

Full Article →The rapidly eroding confidence in our institutions gets plenty of news coverage. We expect it will be a dominant theme for investors in the years ahead. Investing success may require correctly answering the question about what to own in a world where free market forces are taking a back seat to crooked politicians and incompetent central planners.

Full Article →Confidence in institutions such as the Federal Reserve may be falling, but it hasn’t fallen nearly as far or as fast as it should. Trillions of dollars, yen, euros, and yuan are invested according to central bank policy and propaganda. It isn’t going well. The U.S. economy is massively distorted, unhealthy, and hopelessly dependent on Fed stimulus.

Full Article →The Silver Institute released its 2024 World Silver Survey last week. According to the data, silver demand outstripped supply in 2023, for the fifth year in a row. The deficit was just over 142 million ounces. And the forecast for 2024 indicates that the annual production shortfall will nearly double to 265 million ounces.

Full Article →Even after all this country has seen in recent years, some still consider those stocking up on food, ammo, bullion, and other emergency essentials as a little bit nuts. Despite some close brushes with disaster, including the 2008 financial crisis and disruptions associated with COVID-19, it somehow seems hard to believe the nation’s critical systems are at risk.

Full Article →Governor Greg Abbott Delivers Vote of No Confidence

Texas Governor Greg Abbott gave up on the Biden administration doing much to secure his state’s border with Mexico. As an estimated 6 million people, including large numbers of fighting age men, have been pouring illegally into border states over the past 3 years, Abbot has started using the Texas national guard and state police to put up barriers.

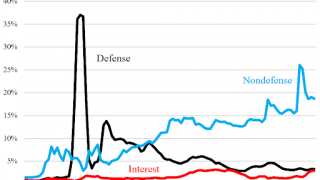

Full Article →US National Insolvency Draws Closer

Bullion investors are naturally concerned about unsound monetary and fiscal policy. Many of them buy precious metals, in part, because they recognize the federal government is out of control when it comes to borrowing and spending. This makes the most recent betrayal by the Republicans in the House of Representatives relevant to our readers.

Full Article →Bitcoin Is No Substitute for Gold

Some proponents still market the crypto asset as “digital gold.” That combined with the dramatic rally in bitcoin prices over the past year means there are plenty of interested investors. There are good reasons to own bitcoin, but they are not the same reasons to own physical gold…

Full Article →Clint Siegner

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group, and winner of Bullion Dealer of the Year’s E-commerce category.

A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.