Are you worried that the big sell-off in gold and silver is the end of the bull market? I’m not, for reasons I have already articulated. And many mainstream analysts don’t seem to be concerned either. Reuters recently published an article headlined, “Gold’s bull run seen intact despite steep pullback.”

Full Article →Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

Investors in the East Line Up to Buy Gold on the Dip

When the price of gold plunged on Friday, Chinese investors lined up at the only Singapore bank selling gold products to retail customers to take advantage of the dip. The underscores a fundamental dynamic in this gold bull market – regular people want the yellow metal, no matter what the big bankers are doing.

Full Article →Surging Gold and Silver Prices Creating Chaos In Chinese Markets

With demand for gold and silver at a fevered pitch, speculative mania has driven premiums in China to extremely high levels, creating tension in the marketplace. As Bloomberg reported, the precious metals frenzy created by rapidly rising prices has increasingly exposed Chinese investors to high levels of risk…

Full Article →Rick Rule: Gold Shows Long-Term Erosion in Purchasing Power

You might think that this gold bull rally is quite young. However, Rick Rule argues that this bull market has really been going on since 2000. The Rule Investment Media CEO told Kitco News rising price of gold reflects a long-term erosion in purchasing power driven by negative real interest rates and ever-expanding government debt.

Full Article →Bank of America Calls $6,000 Gold in 2026

In October, Bank of America raised its 2026 gold price forecast to $5,000. Mission accomplished as of January 23. Now the big bank has upped its projection again, calling for $6,000 gold this year. BoA analyst Michael Hartnett said gold’s performance in past bull markets influenced his thinking.

Full Article →Russia Gold Gains Replace Frozen Assets

Here’s one reason to own gold. The appreciation of Russia’s gold reserves has nearly replaced the value of the assets frozen by the European Union when the country invaded Ukraine. Based on calculations by Bloomberg, the value of Russian gold reserves has surged by $216 billion since February 2022.

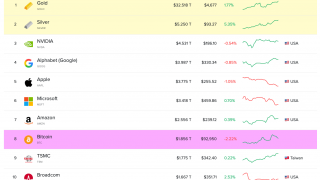

Full Article →Silver Now Second-Most Valuable Asset in the World

Silver was up nearly 148 percent in 2025, and the price has continued to climb in the new year, trading over $90 an ounce. With the rapid gain, silver now ranks as the second-most valuable asset in the world with a market cap of $5.35 trillion.

Full Article →Indian Gold Demand Resilient Despite Record Prices

Indian gold demand has remained resilient, despite record-high prices, driven by strong investment demand. India ranks as the world’s second-largest gold market. The gold price continued to surge in the final month of 2025, with domestic prices in India broadly tracking the global price.

Full Article →The Debt Black Hole Claims Another Victim

The Debt Black Hole has claimed another victim. Saks Global Holdings, the parent company of Saks Fifth Avenue, Neiman Marcus, and Bergdorf Goodman, recently filed for Chapter 11 bankruptcy. The company couldn’t dig itself out from under $2.5 billion in debt. This is a story illustrating how government policy…

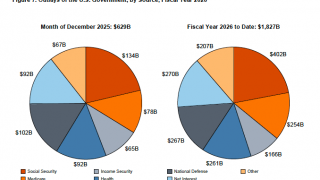

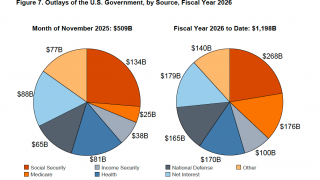

Full Article →U.S. Government – Massive Deficit Despite Tariff Revenue

Despite the influx of tariff revenue, the federal government continues to run a massive budget deficit. The December budget shortfall came in at $144.75 billion, a record for the month. That was 68 percent higher than December 2024. However, looking at just one month gives a bit of a skewed picture.

Full Article →2025 Was a Record Year for Gold ETFs

December capped off a booming year as gold ETFs charted the highest level of gold inflows in dollar terms on record. The gold price set new records 53 times in 2025. That drove investors to pour an unprecedented amount of capital into gold-backed funds.

Full Article →China Is Weaponizing Silver Using Export Restrictions

Silver now finds itself at the center of a geopolitical wrestling match over critical elements. In what is clearly an effort to control the market, China recently announced export controls on silver. This could exacerbate global supply shortages already creating a significant silver squeeze.

Full Article →Gold Tops Treasuries as World’s Biggest Foreign Reserve Asset

Gold now ranks as the world’s top reserve asset. According to World Gold Council data, global gold reserves are approaching $4 trillion. Treasury holdings total approximately $3.9 trillion. The last time central bank gold reserves topped Treasury holdings was in 1996.

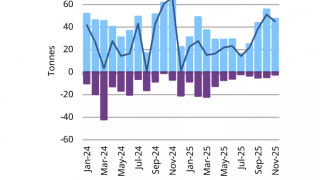

Full Article →Central Bank Gold Buying Momentum Continued in November

Central bank gold buying picked up in September and gained momentum in October. That momentum carried into November with gold reserves continuing to climb. Officially, central banks globally added 45 tonnes of gold to their reserves in November, down slightly from 53 tonnes the previous month

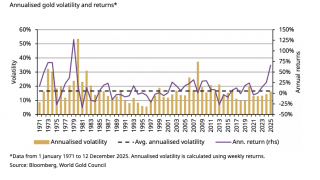

Full Article →Is Rising Volatility Tarnishing Gold’s Appeal?

We’ve seen some sharp price swings in the gold market over the last couple of months. Should this diminish gold’s investment appeal? Volatility has increased without a doubt, but it’s important to put it into context.

Full Article →Financial System Showing Signs of Strain

Repo operations at the Fed on the last day of 2025 signal growing stress in the financial system, similar to the setup we saw in 2019. Banks and other financial institutions borrowed $74.6 billion from the New York Fed’s Standing Overnight Repurchase (repo) Facility on the final day of 2025.

Full Article →Fed Budget Deficit Down Thanks to Tariffs But…

The November deficit came in at $173.28 billion. Through the first two months of fiscal 2026 (Oct-Nov), the federal government spent $457.68 billion more than it took in. That was down 26.7 percent compared to the first two months of fiscal ’25. Looking at it another way, for every dollar the U.S. Treasury received, the Trump administration spent $1.62.

Full Article →India to Allow Gold and Silver Investment in Pension Funds

Regulators in India have revised rules to allow pension funds to invest in gold and silver ETFs. This could further boost already booming investment demand in India. India ranks as the world’s second-largest gold market and consistently falls in the top four silver-consuming nations.

Full Article →Consumer Credit Growth Remains Tepid Signaling Consumer Stress

The U.S. economy depends on consumers buying stuff. Persistent price inflation forced Americans to blow through their savings and then turn to credit cards to make ends meet. However, consumer borrowing has slowed significantly this year, indicating Americans may be maxing out the plastic.

Full Article →Is Silver Set Up to Crash Like 1980 and 2011?

Silver has taken us on a wild ride, nearly doubling in price this year. However, some analysts worry that silver is taking us down a path of disappointment. They base their bearish sentiment on history. After all, silver teased us with twin records in 1980 and 2011 before quickly selling off both times.

Full Article →Deutsche Bank Joins Other Mainstream Banks Raising Gold Price Forecast

With gold trading solidly over $4,000 per ounce, mainstream banks have been scrambling to raise their 2026 price projections. Last week, Deutsche Bank joined the scramble, upping its average price forecast by 11 percent. Deutsche Bank now peg their forecast at a $4,450 average with a trading range between $3,950 and $4,950.

Full Article →Indian Gold Imports Surged in October Despite High Prices

Domestic gold prices in India hit a record in October and outperformed the dollar price. At the end of the month, gold was up 63 percent on the year and 11 percent month-on-month in rupee terms. According to the World Gold Council, “The higher domestic gains are attributed to the 3.3 percent depreciation of the Indian rupee.”

Full Article →Why the Young Can’t Fathom Normal Interest Rates

After the 2008 financial crisis, the Federal Reserve embarked on nearly a decade of extraordinarily loose monetary policy. This not only incentivized the creation of a Debt Black Hole and introduced all kinds of malinvestments into the economy, but it also warped expectations.

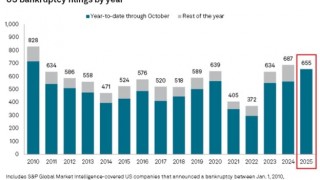

Full Article →Corporate Bankruptcies on Pace for 15-Year High

As the Debt Black Hole continues to impact the economy, corporate bankruptcies are on pace to hit the highest level in 15 years. According to the latest data by S&P Global, 655 U.S. corporations had filed for bankruptcy through October. That compares to 687 for the entirety of 2024.

Full Article →Italy to Tap Undeclared Gold to Plug Budget Hole

The Italian government needs money and wants to tap private gold holdings to get it. Many Italians own undocumented gold. Italian Prime Minister Giorgia Meloni’s government has come up with a scheme to entice people to declare their gold holdings, have them appraised, and then pay a 12.5 percent tax on their value.

Full Article →S&P 500 Vs. Gold: What This Ratio is Telling Us!

The S&P 500 to gold ratio has fallen to the lowest reading since the pandemic and is at a critical support level. This could signal more upside for the yellow metal. Stocks and gold have risen in tandem in 2025. The S&P 500 is up nearly 16 percent on the year, and up 38 percent since the April selloff sparked by tariff worries.

Full Article →Slow Credit Card Spending: Growing Consumer Debt Stress

The U.S. economy depends on consumers buying stuff. Persistent price inflation forced Americans to blow through their savings and then turn to credit cards to make ends meet. Credit card spending has slowed significantly this year, indicating consumers may be maxing out the plastic.

Full Article →Silver Declared “Critical Mineral” By U.S. Government

U.S. Geological Survey (USGS) has officially added silver to its list of “critical minerals.” This could put further demand pressure on a metal already in short supply. It also increases the possibility of tariffs on silver. The USGS critical mineral list was established in 2017, and it guides federal strategy

Full Article →Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.