Despite the influx of tariff revenue, the government continues to run a massive budget deficit.

Bullion.Directory precious metals analysis 15 January, 2026

Bullion.Directory precious metals analysis 15 January, 2026

By Mike Maharrey

Journalist, analyst and author at Money Metals Exchange

The December budget shortfall came in at $144.75 billion, a record for the month. That was 68 percent higher than December 2024.

However, looking at just one month gives a bit of a skewed picture. Calendar effects and delayed payments stemming from the government shutdown last year continue to muddle the accounting. Calendar effects pushed some January payments into December.

We get a better picture of the government’s fiscal trajectory when we look at the last three months (the first three months of fiscal 2026).

Looking at the three-month data, we find tariff receipts are modestly narrowing the budget gap. The deficit is down around 15 percent through the first three months of fiscal 2026 compared to the same period last year.

That may sound like great news until you realize that even with the modest decline, the three-month deficit is still $602.38 billion.

Has Tariff Revenue Plateaued?

Through the first three months of fiscal 2026, the U.S. Treasury collected $90 billion in tariffs. That compares to $20.8 billion through the same period in fiscal 2025. However, it appears tariff revenue may have peaked.

Customs receipts dropped slightly to $27.9 billion in December. That compares to $30.76 billion in November, which was down modestly from a record $31.4 billion in October.

In total, the Treasury collected $484.38 billion in December, a 6.6 percent increase over last year. Through the first three months of fiscal ’26, the federal government has collected $1.23 trillion, up 13 percent over the first three months of fiscal 2025.

It should be clear that claims that the federal government is going to use tariff revenue to pay a “dividend” to poor and middle-class taxpayers and pay down the national debt are nothing but political rhetoric. Math is the great enemy of this ambitious plan. Even with triple-digit percent increases in tariff revenue, the federal government is still running a huge deficit.

The Spending Problem

Surging tariff revenue has helped paper over the real problem. The federal government keeps spending more and more money.

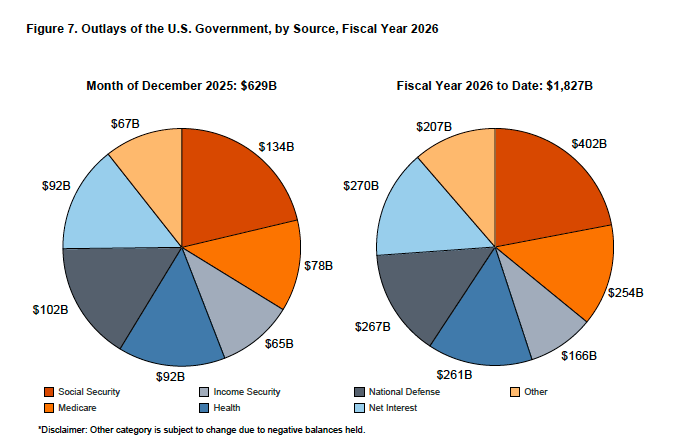

In December, the federal government spent $629.13 billion, bringing the three-month spending total to $1.83 trillion. That’s up about 2 percent over the same period last year.

The increased spending comes despite cuts to the EPA and the Department of Education budget that are now showing up in the data. Lower disaster spending also helped moderate spending levels through the first two months of fiscal ’26.

Looking at the big picture, the spending trajectory is up. Even with all the hype about DOGE and some lip service to cutting spending during the early days of the Trump administration, the U.S. government spent just over $7 trillion last year. That’s an average of $583.3 billion per month or $19.2 billion per day.

Despite some non-specific talk about “spending cuts,” there seems to be little to no commitment to dealing with the runaway spending in a substantial way.

The Big Beautiful Bill trimmed some spending but increased it in other areas. Furthermore, those “cuts” were from projected spending increases. Actual expenditures will still go up, just not as fast as originally planned. The bottom line is that even with the Big Beautiful Bill, spending will increase on an absolute basis. We’re seeing it now.

And all that waste uncovered by DOGE? Virtually none of it was removed from the budget.

This is par for the course.

You might recall that President Biden promised that the [pretend] spending cuts would save “hundreds of billions” with the debt ceiling deal (aka the [misnamed] Fiscal Responsibility Act).

That never happened.

Supporters of the Big Beautiful Bill expect economic growth stimulated by tax cuts to boost revenue and narrow the deficit. However, history casts significant doubt on this claim.

The ugly truth is the government isn’t committed to cutting spending in any meaningful way, and it always finds new reasons to spend even more, whether for “crises” at home or wars overseas.

Debt Is Expensive

On October 21, the national debt surged to over $38 trillion. Less than two months later, the debt stands at $38.4 trillion.

Uncle Sam must pay interest on all that debt. Interest expense has grown into the second-largest spending category in the federal budget behind only Social Security.

In December, the Treasury forked out $153.92 billion on interest expense alone. That pushed interest expense to $354.58 billion through the first three months of fiscal 2026.

Interest on the national debt cost $1.2 trillion in fiscal 2025. That was up 7.3 percent over 2024.

Net interest (interest expense – interest receipts) was $92 billion in December.

Last month, the federal government spent more on interest on the debt than it did on national defense ($102 billion) or Medicare ($78 billion). The only higher spending category is Social Security ($134 billion).

Much of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and must be replaced by bonds yielding much higher rates. And even after the Federal Reserve cut rates, Treasury yields have pushed upward as demand for U.S. debt sags.

Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply