Trump saves global gold market – can he do the same with the U.S. dollar? Of course President Trump said no gold bullion will be subjected to tariffs. Consistent with the original Liberation Day tariff announcement. The Customs & Border Patrol opinion on Swiss gold bars was just a mistake. Story’s over, nothing to see here, move along. So let’s zoom out…

Full Article →You Can’t Blame Big Price Surges Entirely On Tariffs

Producer prices rose significantly more than expected in July, throwing markets into turmoil and calling into question what seemed like an almost certain Federal Reserve interest rate cut in September. The big jump in wholesale price inflation seemed to confirm worries that aggressive tariffs would eventually manifest in higher price inflation.

Full Article →Gold Revaluation, Bitcoin Reserve, and Other Shell Games

Rumors of gold revaluation have been in the news lately. One thing is clear. Politicians have no interest in using the nation’s gold reserves for anything like the original purpose. Americans get smoke and mirrors instead. Officials may like to point to the large reserves and talk about the confidence all that gold inspires.

Full Article →Bolivia Uses Gold to Prop Up Its Finances

The Bolivian government is using gold to maintain its solvency. Large amounts of dollar-denominated debt burden Bolivia, and the country owns the lowest credit rating of any Latin American country, according to S&P Global. The country’s debt is rated Ca, defined as “likely in, or very near, default.” It is the second-lowest rating on the scale.

Full Article →It never ceases to fascinate me how people have a tendency to only remember the things that they actually want to hear… It’s like those car dealerships that promise, “Just $199 down and $199 per month and you can drive away in a brand new car today!” The ad isn’t lying – not exactly. It’s just that the offer might only allow…

Full Article →Economics Professor: Gold Price Could Double in Next Decade

In a recent interview, the Honorary Professor of Economics at the University of Bayreuth and publisher of the BOOM & BUST REPORT said gold and silver are setting up for “important structural breakouts,” and that the price could double in the next five to 10 years. So what is driving gold higher?

Full Article →How Far Is Too Far for Gold Stocks?

My recent gold price forecast for August 2025 included a detailed analysis of the current analogy between now and the 2011 top, and this link remains up-to-date, especially with regard to mining stocks’ strength. Consequently, in today’s analysis, I’d like to focus on the two key things…

Full Article →Tariffs are in the air, with different industries and countries in President Trump’s crosshairs. On Thursday, August 7th he declared that imports from Switzerland would be subject to a 39% tariff. That same day, a ruling letter from the US Customs and Border Protection came to public attention that 1kg and 100oz gold bars are subject to tariffs…

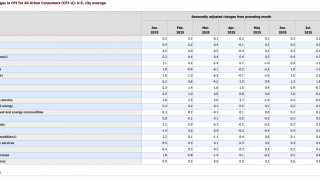

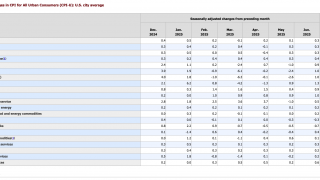

Full Article →July CPI and the Real Inflation Story

The July CPI data indicated moderate price inflation and boosted optimism for a September interest rate cut, even though monetary inflation is on the upswing. There were no big surprises in the July CPI data, with the numbers generally coming in as forecast, but…

Full Article →Gold is holding steady – for now, but not for long. With the Fed cornered and global demand rising, $4,000 gold might be right around the corner. And if today’s bull market is like the 1980s run, how much higher will gold go? Your News to Know rounds up the most important stories about precious metals and the overall economy.

Full Article →Citibank just did a 180 on gold and now forecasts new record highs before the end of the year. Just six weeks after lowering its forecast and warning that gold could drop below $3,000 before the end of the year, Citibank now projects gold will hit $3,500 over the next three months. This would put it in range to eclipse the record high hit in April.

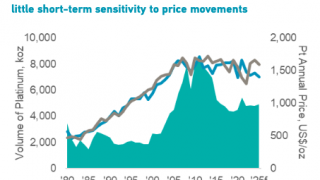

Full Article →Gold outperformed every major asset class in the first half of the year, but it wasn’t the top commodity. That honor goes to platinum, charting a 49.8 percent gain through H1, rising from around $900 an ounce in January to $1,360 at the end of June. That compares with a 25.9 percent increase in the price of gold and a 24.9 percent rise in silver.

Full Article →From Bolivia to Tanzania, central banks are buying up locally mined gold – paying in local currencies, too, rather than dollars. With gold supply tighter than ever and silver poised for a breakout, here’s what the smart money is doing right now… Your News to Know rounds up the most important stories about precious metals and the overall economy.

Full Article →Serbia holds 50.5 tonnes of gold, valued at roughly $6 billion. The country began repatriating its gold in 2021, “an environment of increased global uncertainty,” according to statements by a bank official during a Q&A session. All of Serbia’s gold is now stored in Belgrade, except for 5 tonnes currently held in Swiss vaults.

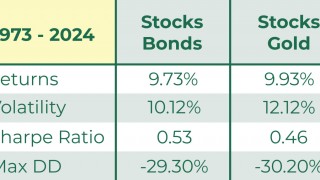

Full Article →For decades, the 60/40 portfolio has been the backbone of traditional investing. It’s simple, time-tested, and grounded in one key assumption: when equities fall, bonds rise. That inverse correlation has been the safety net investors count on to reduce volatility and preserve capital. But what happens when the safety net starts to fray?

Full Article →A leading research firm says gold could climb to $5,500 by 2030 – and that’s their conservative estimate. We break down the global money supply explosion, strange Swiss gold moves and hints Russia plans to target silver price in a quiet war on the West…

Full Article →On Sunday, Commerce Secretary Howard Lutnick made it official: August 1 is the hard deadline for America’s new tariffs to kick in. Appearing on CBS News, Lutnick declared, “That’s a hard deadline, so on August 1, the new tariff rates will come in.” While negotiations can still happen after that date, tariffs will begin applying across the board…

Full Article →Gold was up nearly 26 percent through the first six months of 2025, ranking as the top-performing asset class. This booming performance continued the momentum built in 2024 when gold surged by 26.5 percent. After recording 40 all-time highs in 2024, gold set another 26 all-time highs through the first six months of this year.

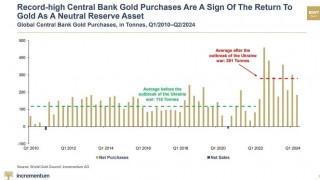

Full Article →Central banks are buying gold like never before. Russia just nationalized a major gold miner, Tether launched a “digital gold” token while billionaires are doubling down on bullion. The message is clear: Owning gold is no longer optional… Your News to Know rounds up the most important stories about precious metals and the overall economy.

Full Article →Are undeclared silver purchases by the Russian government boosting the price of silver? There is some anecdotal evidence that they are. Silver is up nearly 28 percent this year. It briefly traded above $39 an ounce earlier this week. Even with those gains, the gold-silver ratio is over 100-1, signifying that silver is significantly underpriced compared to gold.

Full Article →For years, we’ve warned this was coming. Now, it’s here. The GENIUS Act – short for Guaranteed Electronic Notes Issuance Under Supervision – just passed the Senate with bipartisan support. And unless the House stops it, it could quietly usher in the biggest financial surveillance system in U.S. history – all without the Fed ever touching a retail CBDC.

Full Article →Based on the latest Consumer Price Index (CPI) data, prices showed signs of creeping higher in June. However, there were enough dovish points in the data to support those pushing for looser monetary policy. The headline annual CPI spiked from 2.4 percent in May to 2.7 percent in June, according to the latest data from the BLS.

Full Article →Since hitting an all-time high of $3,500 in April, gold has consolidated and generally traded sideways in a range between $3,200 and $3,400 an ounce. Does this mean the bull run is over? A recent report by Metals Focus argues that while there are still plenty of short-term headwinds, the gold price remains well-supported, with strong potential for further upside.

Full Article →A New Economic War Is Brewing – And This Time, It’s About the Dollar. President Donald Trump just issued a stark warning: “Any country aligning themselves with the anti-American policies of BRICS will be charged an additional 10% tariff. There will be no exceptions.”

Full Article →Several interesting stories featured in the latest edition of the Silver Institute’s bi-monthly Silver News report. Based on the survey, 92 percent of retailers are optimistic that silver jewelry sales will continue to grow for the next several years. That’s up from 88 percent in 2022.

Full Article →Affluent Hong Kong investors have nearly tripled their gold holdings over the last year. According to an HSBC survey, Hong Kong residents with $100,000 to $2 million in investable assets have allocated an average of 11 percent of their portfolios to gold and other precious metals. That was up from a 4 percent allocation just one year ago.

Full Article →As we celebrate America’s independence, there is a lot of focus on the Founding Fathers. After all, they drove the American Revolution. The revolution was a mindboggling accomplishment. It was incredible that rag-tag U.S. forces were able to face down the mighty British Empire.

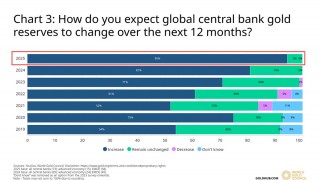

Full Article →The pace of central bank gold buying picked up slightly in May. Globally, central banks officially added a net 20 tonnes of gold to their reserves in May, according to the latest data compiled by the World Gold Council. This compares to 14 tonnes in April.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.