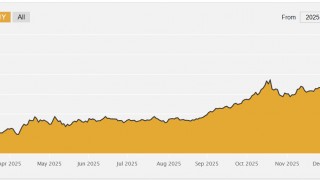

Mainstream Bullish on Gold and Silver Despite Sell-Off

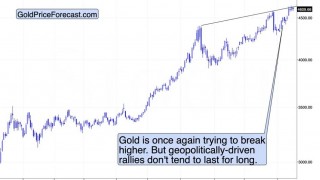

Are you worried that the big sell-off in gold and silver is the end of the bull market? I’m not, for reasons I have already articulated. And many mainstream analysts don’t seem to be concerned either. Reuters recently published an article headlined, “Gold’s bull run seen intact despite steep pullback.”

Full Article →Investors in the East Line Up to Buy Gold on the Dip

When the price of gold plunged on Friday, Chinese investors lined up at the only Singapore bank selling gold products to retail customers to take advantage of the dip. The underscores a fundamental dynamic in this gold bull market – regular people want the yellow metal, no matter what the big bankers are doing.

Full Article →Is Kevin Warsh Good for Gold?

Who Is Kevin Warsh, and Is He Good for Gold? Kevin Warsh’s Fed nomination points to reform and discipline – not upheaval. Markets reacted with cautious relief, even as gold suffered a sharp one-day sell-off. Here’s why that move says more about leverage clearing than about gold’s long-term role…

Full Article →Surging Gold and Silver Prices Creating Chaos In Chinese Markets

With demand for gold and silver at a fevered pitch, speculative mania has driven premiums in China to extremely high levels, creating tension in the marketplace. As Bloomberg reported, the precious metals frenzy created by rapidly rising prices has increasingly exposed Chinese investors to high levels of risk…

Full Article →Silver Reverses Just Below $120, Miners Decline, and Bitcoin…

The intraday reversal in silver just below my $120 target (at $117.75) might have marked the final top for the time being, or we might see another attempt that takes silver to $120 or even a bit above it before a bigger decline (that is then followed by an even more epic silver rally)

Full Article →Rick Rule: Gold Shows Long-Term Erosion in Purchasing Power

You might think that this gold bull rally is quite young. However, Rick Rule argues that this bull market has really been going on since 2000. The Rule Investment Media CEO told Kitco News rising price of gold reflects a long-term erosion in purchasing power driven by negative real interest rates and ever-expanding government debt.

Full Article →Gold Clears $5,000 as Economic Stress Builds

Gold rocketed past $5,000, silver just crossed $100 and the headlines are grasping for explanations – from tariffs to politics. When the narratives stop making sense, it’s usually a sign of something deeper. This week, let’s look at the signals…

Full Article →Bank of America Calls $6,000 Gold in 2026

In October, Bank of America raised its 2026 gold price forecast to $5,000. Mission accomplished as of January 23. Now the big bank has upped its projection again, calling for $6,000 gold this year. BoA analyst Michael Hartnett said gold’s performance in past bull markets influenced his thinking.

Full Article →The Retirement Math Americans Get Wrong

You can do everything right – save diligently, plan ahead, follow the rules – and still come up short in retirement. The problem isn’t effort. It’s assumptions: Inflation, healthcare, and living costs don’t behave the way we expect. So what can we do?

Full Article →Russia Gold Gains Replace Frozen Assets

Here’s one reason to own gold. The appreciation of Russia’s gold reserves has nearly replaced the value of the assets frozen by the European Union when the country invaded Ukraine. Based on calculations by Bloomberg, the value of Russian gold reserves has surged by $216 billion since February 2022.

Full Article →Will the Greenland Threat Push Silver to $120?

A Greenland deal could actually happen. Silver could temporarily rally based on all this. The Greenland saga continues, and it also continues to be remarkably similar to what happened last year regarding the tariff war with China. This title (from Yahoo Finance) pretty much sums it up…

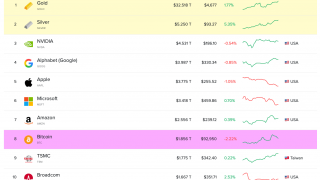

Full Article →Silver Now Second-Most Valuable Asset in the World

Silver was up nearly 148 percent in 2025, and the price has continued to climb in the new year, trading over $90 an ounce. With the rapid gain, silver now ranks as the second-most valuable asset in the world with a market cap of $5.35 trillion.

Full Article →Indian Gold Demand Resilient Despite Record Prices

Indian gold demand has remained resilient, despite record-high prices, driven by strong investment demand. India ranks as the world’s second-largest gold market. The gold price continued to surge in the final month of 2025, with domestic prices in India broadly tracking the global price.

Full Article →The Debt Black Hole Claims Another Victim

The Debt Black Hole has claimed another victim. Saks Global Holdings, the parent company of Saks Fifth Avenue, Neiman Marcus, and Bergdorf Goodman, recently filed for Chapter 11 bankruptcy. The company couldn’t dig itself out from under $2.5 billion in debt. This is a story illustrating how government policy…

Full Article →The USD Index’s Rally Is Quiet – For Now…

Silver futures are flat while gold futures and mining stocks are down – that’s yet another small confirmation of the disconnect between the silver market and the rest of the precious metals sector. They will all react to some factors, but silver has many more reasons to rally in the medium term.

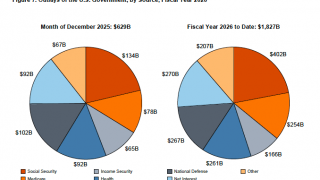

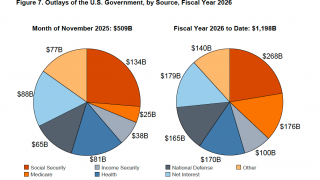

Full Article →U.S. Government – Massive Deficit Despite Tariff Revenue

Despite the influx of tariff revenue, the federal government continues to run a massive budget deficit. The December budget shortfall came in at $144.75 billion, a record for the month. That was 68 percent higher than December 2024. However, looking at just one month gives a bit of a skewed picture.

Full Article →How Currency Stress Is Pushing Gold & Silver to New Highs

As Bloomberg reported, the most recent reports are having trouble keeping up with gold’s gains. The article is written by an analyst from Singapore, whose timezone is 13 hours ahead of Eastern Time. For them, the market is open almost a full day ahead of the New York spot maket on Sunday, and they’ve been watching gold soar.

Full Article →2025 Was a Record Year for Gold ETFs

December capped off a booming year as gold ETFs charted the highest level of gold inflows in dollar terms on record. The gold price set new records 53 times in 2025. That drove investors to pour an unprecedented amount of capital into gold-backed funds.

Full Article →China Is Weaponizing Silver Using Export Restrictions

Silver now finds itself at the center of a geopolitical wrestling match over critical elements. In what is clearly an effort to control the market, China recently announced export controls on silver. This could exacerbate global supply shortages already creating a significant silver squeeze.

Full Article →Gold Tops Treasuries as World’s Biggest Foreign Reserve Asset

Gold now ranks as the world’s top reserve asset. According to World Gold Council data, global gold reserves are approaching $4 trillion. Treasury holdings total approximately $3.9 trillion. The last time central bank gold reserves topped Treasury holdings was in 1996.

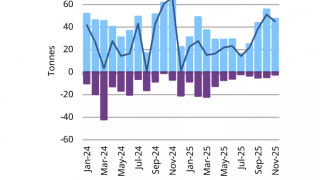

Full Article →Central Bank Gold Buying Momentum Continued in November

Central bank gold buying picked up in September and gained momentum in October. That momentum carried into November with gold reserves continuing to climb. Officially, central banks globally added 45 tonnes of gold to their reserves in November, down slightly from 53 tonnes the previous month

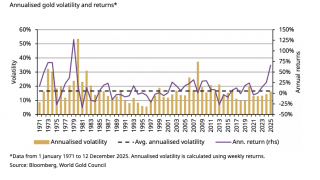

Full Article →Is Rising Volatility Tarnishing Gold’s Appeal?

We’ve seen some sharp price swings in the gold market over the last couple of months. Should this diminish gold’s investment appeal? Volatility has increased without a doubt, but it’s important to put it into context.

Full Article →Financial System Showing Signs of Strain

Repo operations at the Fed on the last day of 2025 signal growing stress in the financial system, similar to the setup we saw in 2019. Banks and other financial institutions borrowed $74.6 billion from the New York Fed’s Standing Overnight Repurchase (repo) Facility on the final day of 2025.

Full Article →Fed Budget Deficit Down Thanks to Tariffs But…

The November deficit came in at $173.28 billion. Through the first two months of fiscal 2026 (Oct-Nov), the federal government spent $457.68 billion more than it took in. That was down 26.7 percent compared to the first two months of fiscal ’25. Looking at it another way, for every dollar the U.S. Treasury received, the Trump administration spent $1.62.

Full Article →Gold: Bulls Are Still Swinging but the Ceiling Isn’t Giving Up Easily

Even though bulls managed to break above the upper border of the black rising wedge, the proximity of the October highs, combined with two bearish engulfing patterns, proved too heavy on Friday. Price pulled back and closed the day (and the entire week) back inside the wedge.

Full Article →India to Allow Gold and Silver Investment in Pension Funds

Regulators in India have revised rules to allow pension funds to invest in gold and silver ETFs. This could further boost already booming investment demand in India. India ranks as the world’s second-largest gold market and consistently falls in the top four silver-consuming nations.

Full Article →Silver: Breakouts Don’t Whisper – They Deliver

Silver remains firmly in bullish territory. Momentum is strong, structure is intact, and the price continues to respect higher levels despite short-term overbought readings. This is a market that’s not asking if – it’s asking from where. Yesterday, bulls didn’t just reach that zone – they pushed straight through it

Full Article →Silver Breaks 6000 And the Bulls Aren’t Done Yet

Silver bulls smashed through the key red resistance zone just above 5900, closed the gap, and broke that long-standing psychological wall at 6000. What happened next? A textbook follow-through. Asia picked up the bullish baton, the market gapped higher and silver… printed fresh highs at 6213.50.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.