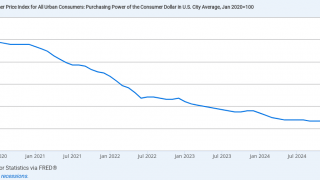

The U.S. economy depends on consumers buying stuff. Persistent price inflation forced Americans to blow through their savings and then turn to credit cards to make ends meet. However, consumer borrowing has slowed significantly this year, indicating Americans may be maxing out the plastic.

Full Article →Former Treasury Secretary Sounds Alarm on Debt

When a Treasury Secretary Sounds the Alarm, We Should Pay Attention. Former Treasury Secretary Robert Rubin says today’s debt trajectory echoes past periods of financial strain. Treasury data backs him up. Here’s why rising interest costs and structural deficits matter more than any headline…

Full Article →Is Silver Set Up to Crash Like 1980 and 2011?

Silver has taken us on a wild ride, nearly doubling in price this year. However, some analysts worry that silver is taking us down a path of disappointment. They base their bearish sentiment on history. After all, silver teased us with twin records in 1980 and 2011 before quickly selling off both times.

Full Article →Why Are Central Banks Escalating Gold Buying?

Gold is creeping higher with almost no fanfare, silver is surging to fresh records, and even Russia is warning that G7 nations may seize foreign reserves. Beneath the headlines is a simple reality: trust in global finance is eroding, and physical precious metals are quietly becoming the preferred safe harbor…

Full Article →Deutsche Bank Joins Other Mainstream Banks Raising Gold Price Forecast

With gold trading solidly over $4,000 per ounce, mainstream banks have been scrambling to raise their 2026 price projections. Last week, Deutsche Bank joined the scramble, upping its average price forecast by 11 percent. Deutsche Bank now peg their forecast at a $4,450 average with a trading range between $3,950 and $4,950.

Full Article →Indian Gold Imports Surged in October Despite High Prices

Domestic gold prices in India hit a record in October and outperformed the dollar price. At the end of the month, gold was up 63 percent on the year and 11 percent month-on-month in rupee terms. According to the World Gold Council, “The higher domestic gains are attributed to the 3.3 percent depreciation of the Indian rupee.”

Full Article →Gold: Under-Owned, Under-Supplied and Overdue

Gold is still just 2% of global assets, even as physical supply runs a 1,000-ton deficit and new demand surges from central banks and a surprising new source. UBS sees silver outperforming gold in the short-term for similar reasons. Here’s what you need to know…

Full Article →Why the Young Can’t Fathom Normal Interest Rates

After the 2008 financial crisis, the Federal Reserve embarked on nearly a decade of extraordinarily loose monetary policy. This not only incentivized the creation of a Debt Black Hole and introduced all kinds of malinvestments into the economy, but it also warped expectations.

Full Article →Two Investing Titans Issue the Same Warning

Two very different billionaires, one warning: When Ray Dalio and Jeff Gundlach – two legendary investors with wildly different worldviews – start warning about the same thing, it’s worth paying attention. Both say today’s economy is distorted, and warn that “illusory wealth” may vanish when reality hits…

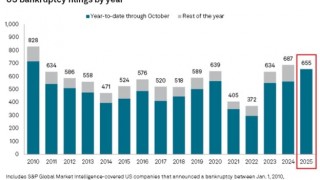

Full Article →Corporate Bankruptcies on Pace for 15-Year High

As the Debt Black Hole continues to impact the economy, corporate bankruptcies are on pace to hit the highest level in 15 years. According to the latest data by S&P Global, 655 U.S. corporations had filed for bankruptcy through October. That compares to 687 for the entirety of 2024.

Full Article →Italy to Tap Undeclared Gold to Plug Budget Hole

The Italian government needs money and wants to tap private gold holdings to get it. Many Italians own undocumented gold. Italian Prime Minister Giorgia Meloni’s government has come up with a scheme to entice people to declare their gold holdings, have them appraised, and then pay a 12.5 percent tax on their value.

Full Article →S&P 500 Vs. Gold: What This Ratio is Telling Us!

The S&P 500 to gold ratio has fallen to the lowest reading since the pandemic and is at a critical support level. This could signal more upside for the yellow metal. Stocks and gold have risen in tandem in 2025. The S&P 500 is up nearly 16 percent on the year, and up 38 percent since the April selloff sparked by tariff worries.

Full Article →Slow Credit Card Spending: Growing Consumer Debt Stress

The U.S. economy depends on consumers buying stuff. Persistent price inflation forced Americans to blow through their savings and then turn to credit cards to make ends meet. Credit card spending has slowed significantly this year, indicating consumers may be maxing out the plastic.

Full Article →Silver Declared “Critical Mineral” By U.S. Government

U.S. Geological Survey (USGS) has officially added silver to its list of “critical minerals.” This could put further demand pressure on a metal already in short supply. It also increases the possibility of tariffs on silver. The USGS critical mineral list was established in 2017, and it guides federal strategy

Full Article →Silver Just Gained a Historic Advantage

As gold rebounds past $4,000, the lone bearish forecast quickly collapses under its own logic. Meanwhile, silver gains new strategic importance on Washington’s “critical minerals” list. Here’s why gold and silver are poised to shine even brighter. Rounding up the most important stories about precious metals

Full Article →Not Enough Silver… or Just in the Wrong Location?

Early this year, high premiums developed for COMEX bars in the U.S. thanks to fears of tariffs on importing silver (and gold). In response, traders shipped an estimated 300 tons of silver from London to New York to alleviate that squeeze. Last month, the London Bullion Market ran into some issues of its own with respect to silver

Full Article →Who Will Survive This “K-Shaped Economy”?

Economies usually go just one way – but now we’re going in two directions. While the wealthy ride up on rising asset prices, millions of working Americans are moving down. Here’s how the “K-shaped” economy took hold – and what it means for your financial future…

Full Article →ETF Boost in Gold Holdings for Fifth Straight Month

After charting the highest level of gold inflows on record in September, the flow of gold into ETFs slowed modestly in October but remained comfortably above the year-to-date average. It was the fifth straight month of net gold inflows into ETFs globally. In total, 54.9 tonnes of gold flowed into gold-backed funds last month.

Full Article →AI Bubble? Gold Savers Will Win the Long Game

Gold’s brief slide below $4,000 has pundits cheering – but traders, not fundamentals, drove the move. Silver’s scarcity tells a different story, and Bank of America now recommends gold as the smart hedge against the frenzied AI boom… Your News to Know rounds up the most important stories about precious metals.

Full Article →Central Bank Gold Buying Hit Highest Level of the Year

Central bank gold buying hit the highest level of the year in September, with several new banks adding to their reserves. Globally, central banks officially added a net 39 tonnes of gold to their holdings in September. That was up 79 percent month-on-month and was above the 12-month average of 27 tonnes.

Full Article →Don’t Let the Precious Metals Bull Shake You Off

Investors have to manage their emotions and deal with surprises in order to succeed. This is particularly true for bullion investors, who can expect more than their share of volatility and unexpected price action. Gold and silver are not favored assets, unlike real estate, Treasuries, or U.S. equities…

Full Article →Is the Silver Bull Market Over?

Silver has been on a wild roller coaster ride. Is the recent selloff a temporary correction or have we reached the end of the rally? While the supply displacement has moderated somewhat, the underlying dynamics that have been driving both silver and gold higher over the last two years remain in place.

Full Article →New Trend: Family Arguments Over Inflation

As rising costs squeeze younger generations, a disturbing trend is spreading: “inheritance impatience.” Adult children are pressuring parents (and grandparents) for early access to their estates – draining retirements before they begin… Let me start with a question you’ve probably never asked yourself

Full Article →Gold Price Forecast for November 2025

This time, the gold price forecast is not as much about predicting gold prices, as it is about realizing what’s going on in the USD Index. The Fed cut rates. Again. The USD Index rallied. Also, again. The Fed’s decision to cut rates again was widely expected, so it was “in the price” for some time now but…

Full Article →Fed Hawkish Front Fools No One.

For the second straight meeting, the Fed cut the federal funds rate by a quarter percent on Wednesday. The FOMC also announced balance sheet reduction will end December. However, Fed Chairman Jerome Powell tried to keep the party from heating up too much by downplaying the possibility of another cut in December.

Full Article →Gold Bulls Take a Beating But Are They Down and Out?

Gold has been pounded recently and is now struggling to hold the $4,000 level. Are the bulls dead? It’s important to keep the selloff in perspective. As I put it in my podcast last week, “keep your eye on the ball.” Corrections are healthy and normal in a bull market. But a big selloff could also indicate the end of a bull run. So, where are we now?

Full Article →Indian Gold Demand Strong in September Despite High Prices

According to the World Gold Council, the festival season started on a “positive note” with healthy demand. “Despite the pressure on gold jewelry consumption due to high prices and affordability, there has been a recent sales uptick, predominantly concentrated around wedding-related purchases and aligning with the wedding season.”

Full Article →Welcome to Staglflation 2.0

CEO confidence has slipped below the danger line, signaling what many already feel: Higher prices, slower growth, and fading optimism. With inflation rising and growth stalling, even corporate America sees the specter of 1970s-style stagflation returning… And concerned Americans are doing the same things that many CEOs are planning for right now.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.