Despite all the talk about DOGE and cost-cutting earlier this year, the federal government spent more in fiscal 2025 than it did the previous year and set a new spending record. However, thanks to an influx of tariff revenue, the fiscal 2025 budget deficit was slightly smaller – if you can call a $1.78 trillion deficit “small.”

Full Article →Forget the “Great Wealth Transfer”… This Is Far Worse

When governments run out of money, they don’t tighten belts – they borrow and print. That’s called “debasement,” and it quietly drains value from every dollar we earn and save. Here’s how the “debasement trade” is changing the investing landscape… And how are central banks being used to do it

Full Article →20 Percent Portfolio Allocation to Gold and Silver Now Mainstream

In a seismic shift, Morgan Stanley CIO Michael Wilson recently came out with an investment strategy that includes a 20 percent allocation to gold. Now a Sprott executive has followed suit, telling a mainstream financial network’s audience that investors should consider shifting from the traditional 60/40 portfolio to a 60/20/20 allocation.

Full Article →Bank of America Ups 2026 Gold Price Forecast to $5,000

With gold scaling record highs on what feels like a daily basis, mainstream financial analysts are scrambling to raise their price forecasts. Goldman Sachs recently upped its 2026 price projection to $4,900. Not to be outdone, Bank of America has now raised its 2026 forecast to $5,000 an ounce.

Full Article →Gold Stocks Refuse to Rally with Gold

The GDXJ ETF, proxy for junior and mid-tier gold/silver miners looks like it’s done rallying, and its move above $100 will be invalidated shortly. No wonder. We saw a daily reversal, which happened on big volume, and it all took place at the vertex of the lines creating the previous rising wedge formation, which itself broke to the downside.

Full Article →Morgan Stanley Recommends 20% Allocated to Gold

Is Wall Street starting to embrace gold? For years, mainstream investment gurus have steered clients away from gold. But with the yellow metal gaining more than 87 percent since January 2024, it’s getting hard to ignore the yellow metal. Morgan Stanley recently came out with an investment strategy with a 20 percent allocation to gold.

Full Article →Who in Their Right Mind Would Hold Dollars?

Nobody in their right mind would hold their reserves in dollars. That’s the conclusion of Catalyst Funds CIO David Miller. And he’s right. Gold is up over 87 percent since January 2024 and is knocking on the door of $4,000 an ounce. But even with the rapid price surge, Miller said gold is not overpriced.

Full Article →Gold: Not Just for the Government Shutdown!

CNCB says investors should have gold as a hedge if the government shutdown persists. But they miss the real problem. That comes after the government reopens! At midnight on October 1, the feds shut the doors, turned out the lights, and went home. Well, some of them did.

Full Article →U.S. Government Shuts Down… For A Short While

It turns out I was wrong regarding the government shutdown when we look at it at first sight, but I don’t think I’ll be proven wrong on this in the practical sense of what I wrote. The fact that we did see the government shutdown doesn’t change that much. What matters is how long it will remain shut down.

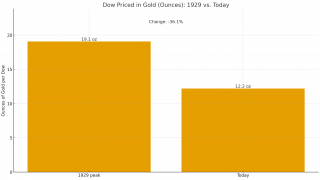

Full Article →Inflation: Dow Down 36 Percent in Gold Terms Since 1929

Most people define inflation as rising consumer prices. Price inflation is part of the inflationary equation, but inflation also manifests in other ways, for instance, in asset inflation. Keep in mind that inflation, properly defined, isn’t about prices. It is an increase in the supply of money and credit.

Full Article →Government Shutdown Theatre Fuels More Gold Gains

Rumors of a federal government shutdown are once again swirling. Absent a deal, non-essential agencies will have to suspend operations until legislators put together a spending deal. Americans have another front row seat to the public relations battle between Republicans and Democrats to see which party is most to blame for the impasse.

Full Article →Why Economic Growth Is Losing Its Meaning

Growing up, illusions were a wonderful thing. Watching David Copperfield fool the audience on television was amazing, even magical.As you get older, though, you realize that there are really two different types of illusions, one magical and wonderful. The other, a sort of con game to distract us from paying attention to what really matters.

Full Article →SHOCKER! Inflation Worse Than Government Data Reveals

You can file this under things you already knew. Price inflation is worse than the official data indicates. Based on the Consumer Price Index, price inflation is running at 2.9 percent, with core inflation at 3.1 percent. Both numbers are far above the mythical 2 percent target, but the situation is even worse for real people trying to live real lives.

Full Article →Why This Gold Surge Is Different (It’s a Revolt!)

Gold has doubled since 2023 and forecasts call for much higher. But this isn’t just another rally. While the Fed cuts rates and analysts warn of the global currency crisis, gold’s record run looks more like a rebellion against unbacked currency itself. Your News to Know rounds up the most important stories about precious metals…

Full Article →CNBC Finally Notices Gold – But Gives Bad Investment Advice

I’d like to congratulate CNBC on finally noticing gold! It only had to trade above $3,700 an ounce to get the big network’s attention. While I have to give CNBC credit for finally recognizing that gold might be a good investment (after all, it’s only up 82.9 percent since January 1, 2024), I’m not particularly impressed with their advice.

Full Article →China Challenges Dollar Dominance Like Never Before

You’re probably already aware that the U.S. dollar has had its worst start to a year since 1973. That made headlines worldwide. Now, the U.S. has been the world’s reserve currency for decades meaning that the dollar has been, essentially, the yardstick by which other currencies are measured. A decline in the dollar’s value is bad news.

Full Article →Fed Rate Cut: Cranking Up the Inflation Machine

The Federal Reserve cranked up the inflation machine, despite acknowledging “inflation has moved up and remains somewhat elevated.” The FOMC voted 11-1 to cut the federal funds rate by a quarter percent, setting the interest rate between 4 and 4.25 percent.

Full Article →Scientists Extract Silver – Using Cooking Oil

Want some silver? You might be able to get some with your phone, some hydrogen peroxide, and a bottle of cooking oil. Mind you, you won’t be able to use your phone ever again. But you’ll have silver! Researchers have discovered a way to recover silver from electronic waste using cooking oil.

Full Article →Cost of Living Is Falling Fast… Relative to Gold

Rising prices are a political football with politicians on both sides of the aisle eager to pin blame on the other party. Both sides are correct. Politicians, along with the central bank they created and continue to endorse, are fully responsible for the affordability crisis and the fading American dream.

Full Article →The Real Reason Gold Is Surging

(They Don’t Want You to Know This) Gold has surged to $3,600, yet mainstream media still struggles to explain why. The truth is simple: Currencies are weakening worldwide. No wonder central bank gold buying is surging, and silver is stepping into the spotlight. Here’s what happens next…

Full Article →The Best Way to Buy Silver Right Now?

Bid and ask premiums for 90% silver U.S. coins are perhaps the most volatile of any among retail bullion products. At the recent peak of retail buying demand in 2023, ask premiums for these older, circulated dimes, quarters, and half dollars went north of $15/oz over spot. Today, ask premiums are south of $1/oz.

Full Article →ETFs Continue to Pile in Gold

For the third straight month, gold flowed into ETFs globally, led by North American and European funds. This continues the general trend this year. Gold inflows into ETFs through the first half of 2025 hit levels not seen since the pandemic. Year-to-date ETF gold inflows of $47 billion are the second-strongest on record

Full Article →So… The Gold Bugs Are Right!

The gold bugs are right. Gold is an important asset that everybody should hold. And yet, the mainstream looks at these so-called gold bugs with derision. Let me tell you in an illustrative story. I almost didn’t get into reporting and writing about precious metals because I didn’t want people to think I was some kind of weirdo.

Full Article →2 Reasons Gold Is Smashing Records AGAIN

Gold just surged past $3,500 as mounting debt and looming Fed rate cuts shake confidence in the dollar. Silver is quietly outperforming, while turmoil in West Africa adds fuel to supply concerns. Here’s what’s next for gold and silver prices…

Full Article →Fed Feuds Make Headlines – Debt Makes the Rules

Trump vs. the Fed makes for great theater. But while the media fixates on name-calling and accusations, the real story is fiscal dominance. We live in an age of distractability. Every second that you’re awake of every day of the week, we are surrounded by, submerged in a constant never-ending barrage of information, marketing, and viewpoints…

Full Article →Silver Demand Surges But U.S. Still on the Sidelines

With the price of silver up 25 percent through the first six months of 2025, investment demand has surged. However, U.S. investors have not hopped on the bandwagon – yet. The increase in investment demand is reflected by a big jump in ETF silver holdings. Through the first six months of the year, 95 million ounces…

Full Article →First came Goldman Sachs, then Morgan Stanley – and now analysts at Swiss megabank UBS have recommended that investors buy gold as a hedge against economic turbulence. Those same analysts have adjusted their gold price forecasts modestly: $3,600 by Q1 of next year; $3,700 by Q2.

Full Article →Gold and the Myth of “Fed Independence”

The establishment financial media is in a tizzy this week over Trump’s firing of Fed Governor Lisa Cook, a Biden appointee accused of mortgage fraud. They complain that this firing is an assault on the Fed’s independence. In reality, though, the notion of ‘Fed independence’ is a myth.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.